The passage of the Student Loan Forgiveness Act of 2012 would help students stay in college and get their degree, pay their student loans and help spur the American economy.

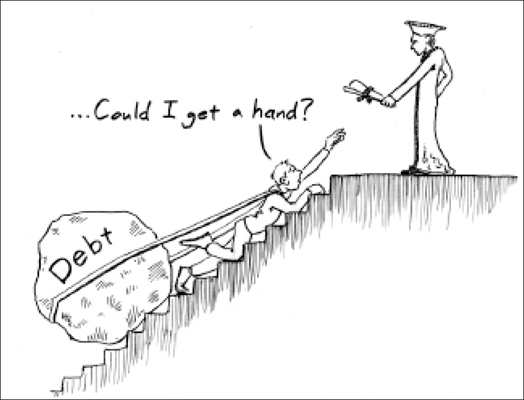

Students are taking on an ever-increasing amount of student loan debt, totaling more than $1 trillion, according to USA Today. This amount, for the first time, is higher than American credit card debt.

This high amount of student loan debt is starting to adversely affect students and the American economy. Twenty-five percent of 2010 college graduates are behind on their student loan payments.

If the number of students not being able to pay their loans continues to increase, the American economy could collapse in much the same manner that it did in 2008, because homeowners could not pay their mortgages. The similarities between the 2008 housing bubble and the current higher education bubble are eerie.

The Student Loan Forgiveness Act would cap payments on federal student loans at 10 percent of discretionary income per month. According to Yahoo News, after making monthly payments for 10 years, your federal student loan debt, up to approximately $45,000, will be forgiven by the federal government.

This legislation would allow graduates in the Public Service Loan Forgiveness Program to have their federal student loans forgiven in five years instead of 10 years.

These aspects of the Student Loan Forgiveness Act would allow many students to stay in college and make payments on their federal student loans instead of ending up in default.

There are worries about how this legislation will be funded and if it will add to the ballooning federal deficit. This legislation, in its own language, is funded by future appropriations available through the Overseas Contingency Operations.

The Overseas Contingency Operations budget funds mainly the military operations in Afghanistan and the military operations that occurred in Iraq in the past. It is not clear what the Student Loan Forgiveness Act would do to the U.S. budget deficit.

It’s possible that there will be extra money in the Overseas Contingency Operations budget to fund this legislation. Just as easily, the exact opposite could be true. More transparent information is needed to know whether this would negatively affect the federal budget.

One thing is certain; the Student Loan Forgiveness Act would help students get an affordable college education and improve the American economy.