Now with the inevitability that President Obama will face off against Mitt Romney in the 2012 U.S. general election, Obama must campaign on an aggressive progressive agenda and defend the idea of government against the libertarian idea that government exists to destroy liberty.

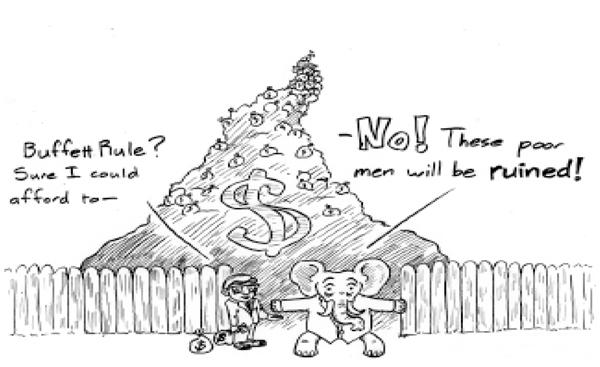

The Buffett Rule, a proposal advocated by Obama that would impose a minimum 30 percent tax on individuals making more than $1 million, has broad support among Americans. The most recent Gallup poll showed 60 percent of Americans supported the Buffett Rule.

Even with this large support for making our tax system more fair and just, the Republican Party and Mitt Romney’s presidential campaign oppose this policy.

“President Obama is the first president in history to openly campaign for re-election on a platform of higher taxes,” said Gail Gitcho, a Romney spokeswoman, according to U.S. News. “He has already raised taxes on millions of Americans, but he won’t stop there. He wants to raise taxes on millions more by taxing small businesses and job creators.”

Does the Republican Party really expect people to believe that the Buffett Rule will hurt “job creators?” How could it hurt them when, according to a report by the Government Accountability Office, two-thirds of U.S. corporations paid no federal income tax between 1998 and 2005? The Buffett Rule would simply make the rich pay their fair share.

The Republican Party has been suggesting that the Buffett Rule is part of a broader goal of Democrats engaging in class warfare to win votes next election. This isn’t true.

The Buffett Rule has been supported by some of the richest people in the United States. This includes Microsoft founder Bill Gates, art philanthropist Eli Broad, New York City Mayor Michael Bloomberg, Dallas Mavericks owner Mark Cuban and Warren Buffett himself.

“My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice,” wrote Buffett in a New York Times op-ed last August.

See, it’s not class warfare to tax the rich more. Many rich Americans believe that they should be taxed more. They believe in the idea that no one makes a fortune without some help.

They think once they have been successful enough to become rich, they should have to pay more of their wealth in taxes to make sure other people have a chance to get an affordable education or health care insurance. This is the very idea of civil society: people coming together for the common good.

Other rich Americans, such as Koch Industries Inc. CEO Charles Koch, see government not as an institution that promotes people’s happiness, but rather a destroyer of individual liberty.

“Much of what the government spends money on does more harm than good; this is particularly true over the past several years with the massive uncontrolled increase in government spending,” said Koch. “I believe my business and non-profit investments are much more beneficial to societal well-being than sending more money to Washington.”

Charles Koch is correct that government “can” do more harm than good. In the U.S., this usually occurs because of economic -rent seeking. Rent seeking occurs when businesses or industry groups lobby Congress to water down legislation in their favor.

Sometimes rent seeking can go to the extreme with former corporate CEOs running federal agencies, such as when former Goldman Sachs CEO Henry Paulson ran the Treasury Department under President George W. Bush.

Government works. But for it to work, the richest people in the United States can’t be running the country.

Without assistance from the government over my lifetime, I would not be writing this column. I needed Federal Pell Grants to be able to afford college. Even with government assistance, I will be more than $25,000 in undergraduate student loan debt, with much more to come in the future after graduating law school.

Was I lazy? Did I lack the intellectual capacity for a college education? No, I simply lacked the resources to afford a university education on my own or with my parents’ help. We just didn’t make enough money.

We needed the government (civil society) to help us. In the future, if I’m fortunate enough to have an upper class income, I have no problem paying a 35 percent marginal tax rate to ensure that a young person such as me can also realize his or her true potential through a reduced or free education.

People like Charles Koch complain about government, but in reality, they love it. They love how corporations have infiltrated the political process and have stacked the deck in their favor against the interests of consumers, the environment and social justice.

They want a government that won’t touch their wealth instead of a government that promotes the common good.

In order to win the 2012 election, President Obama will have to push for progressive policies like the Buffett Rule to show that the U.S. government helps people, as long as corporations don’t dominate our government.