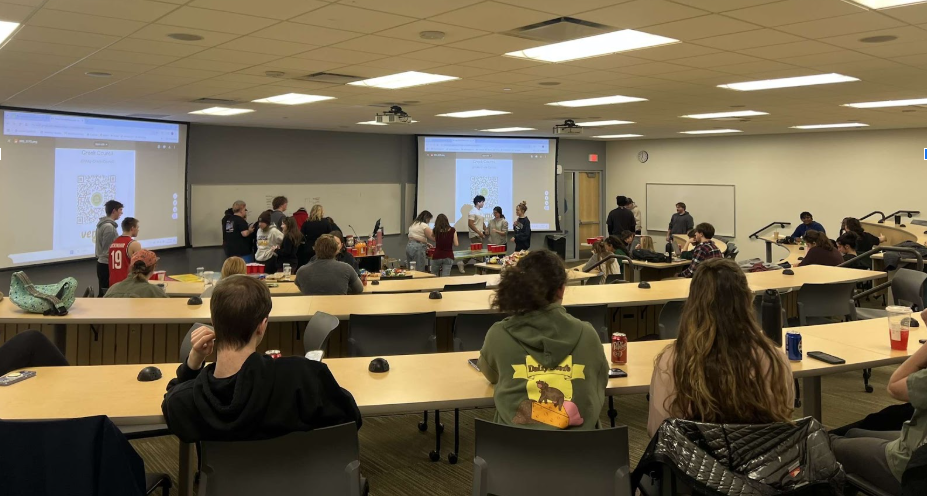

The Earth, Environmental, and Geographic Sciences Department (EEGS), Students for Sustainability and Transition Marquette sponsored a presentation by Oxford scholar Nicole Foss and alternative currencies advocate Laurence Bloomert on Tuesday, Oct. 29 in Jamrich to address the global financial crisis, resource scarcity and creative responses to both dilemmas.

Foss and Bloomert focused on barriers to perpetual economic growth, particularly ecological walls that could foil the quest for continued growth.

Tuesday was Foss’ second time presenting at NMU, though it was Bloomert’s first visit. They also lectured in professor Richard Eathorne’s economic geography class Wednesday morning.

The presentation, titled “Facing the Future: The Global Financial Crisis” was introduced by NMU professor Steve Degoosh, a friend of Foss’.

“Last time you presented here in Kaufmann Auditorium, a few people left because they felt overwhelmed,” Degoosh said, speaking to Foss.

Foss has been studying the financial sector and its relevance to resource scarcity for over 20 years. Her material focuses on what she terms the “boom-and-bust” cycle of economic growth, with the caveat that the modern financial crisis is unique in that it is paired with depleted resource availability, namely in the forms of oil and natural gas scarcity. Where these forces intersect, Foss asserts, is the crux of the modern dilemmas like oil and gas scarcity, mass financial peril and climate change.

To Foss, as resources deplete, they will be more and more difficult to tap. She utilized a college-appropriate metaphor to illustrate her points.

“You’re thirsty and you want another drink,” Foss said. “You go up to the bar and buy another beer. That’s the conventional way of getting energy. Or, if you’re really desperate and low on resources, you suck beer out of the carpet. That’s where we are now.

“Money is the lubricant in the engine of the global economy in the way oil is the lubricant in the engine of a car,” Foss said. “We’ve created an enormous amount of virtual wealth, but very little wealth of substance.”

The “virtual wealth” Foss refered to was credit, which composes approximately 99 percent of the current global money supply. Credit is created in the form of loans and electronic money. Foss’ assertion is that an inordinate amount of credit creates volatile circumstances for the global economy. As credit grows exponentially, a limit must be hit that means no more credit can be created and existing money will begin to devalue.

Foss asserts that we are heading for an abrupt “credit crunch,” or global economic depression. In Foss’ view, an economic depression will value credit at zero and subsequently increase the value of physical currency.

Bloomert followed Foss’ daunting material in both Tuesday’s and Wednesday’s (Oct. 30) presentations to offer community alternatives to the current financial system. Bloomert has worked in crisis planning and organic farming since the 1980s.

“I started looking at the trajectory of [economic and population] growth in the early ‘80s,” Bloomert said. “By the late ‘80s, I was living on my farm in the foothills.”

Bloomert, like Foss, finds problems in the structuring and security of modern finances.

“Oil hit $147 a barrel in 2008, the world doesn’t run on $147 a barrel,” Bloomert said. “Truck drivers said ‘We can’t deliver to the supermarket,’ and fishers said ‘We can’t go out and fish.’” Prices were just too expensive.

Bloomert advocates a decentralization of finances, energy and manufacturing. Offering alternatives like solar power, low-scale wind power and 3-D printing for manufacturing is only the beginning.

Decentralizing currency would involve monetary forms like BitCoin, an online money system not tied to the Federal Reserve. To Bloomert, alternative currency forms, like Timebanks, Barter cards (common in England, Australia and Bloomert’s home, New Zealand) or a Local Exchange Trading System (L.E.T.S.), are currencies of a future characterized by economic depression and resource scarcity.

“We’re creatures of comfort,” Bloomert said. “We don’t change when we’re comfortable. Most of Earth’s biosystems are in a state of crisis. Whatever happens, we’re heading headfirst into a reality revolution.”

Students interested in either study can find Foss at www.theautomaticearth.com and Bloomert at www.neweconomics.net.nz.