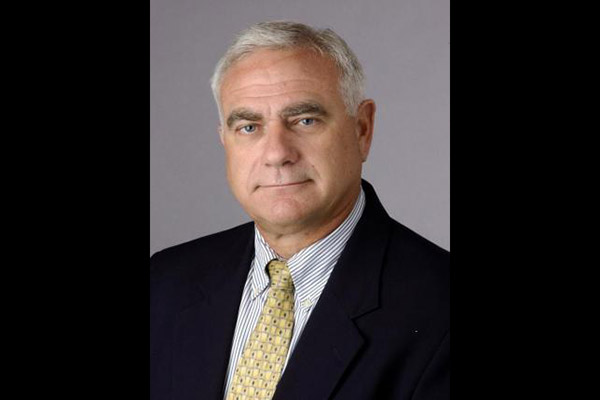

Martin Regalia, vice president of economic and tax policy as well as chief economist at the U.S. Chamber of Commerce, spoke to a classroom of students on Monday afternoon about the nation’s current fiduciary situation.

Regalia, who has been named one of the top 10 economists in the nation, gave his take on a situation currently being lived through by everyone not in “The Fantasyland on the Potomac”; that is to say, Regalia’s Washington D.C.

“The economy is recovering,” he began, giving the audience a little bit of familiar language to digest. “However, it’s recovering at such a weak rate that we hardly notice.” He went on to demonstrate that while the U.S. economy has been consistently improving since mid-2009, the recession we entered in 2007 lasted longer than usual (18 months versus the norm, which is approximately 16 months).

Another key contributor to our lack of perceivable improvement is the growth rate we’re experiencing.

While the steepness of a recession is generally a positive indicator of the steepness at which the economy will rebound, this was a very steep recession with a very shallow climb out of the hole.

In the past—Regalia gave examples of recessions in the early 1980s and ‘90s—GDP growth following the recessions was between 2 and 3 percent higher than what we’re currently experiencing. Because of the slower recovery rate it’s true that we’re less likely to boom, peak and fall again within this decade; however, Regalia said, it also marks a failure to “store up during fat years to outlast the years of famine, in a biblical sense.”

What this means is while the economy looks stable due to a less volatile growth rate and less up-down cycling, we’re left with less of a buffer should outside forces act upon our markets—such as an economic scare in China or Greece.

“Without the cushion of a GDP that’s surpassed the line of potential growth, the economy is susceptible to outside shocks,” Regalia said. “And that’s where we’re at.”

In fact, according to statistics from the U.S. Congressional Budget Office, our GDP growth rate is unlikely to intersect with the line of potential (preferred) GDP growth rate within the next two decades.

This means while we will indeed have an overall upward trend in the long term for our GDP values, the U.S. economy will remain unshored and un-insulated to outside shocks.

What are the factors behind this prediction? Regalia was candid in his impressions and not-entirely politically correct.

“People leaving the workforce before their time—people able to work but not bothering to search for jobs—make it seem like our unemployment rate is shrinking. Technically, it is.”

But, he went on to say, the problem is that the government pays out to keep those people fed and taken care of, since they won’t do it for themselves; in short, less of the workforce going to work means more of the government’s money being spent on necessities that most people ought to be able to go out and earn themselves.

A student in the audience raised his hand and asked about increasing minimum wage: “Wouldn’t that help the situation, if low-end workers made more?” the student asked.

“Actually, our information says no. Not really,” Regalia said. He outlined some numbers on the markerboard: 46.7 million people in the U.S. are currently living below the poverty line. Only three million of those people are earning minimum wage in the workforce. And of those three million, only a small percentage are truly reliant on their income; most of this small group are high school and college students, putting extra pizza and gas money in their pockets while their parents deal with the big bills, according to Regalia.

As demonstrated with this math, raising the minimum wage would indeed help a subset of people afford more stuff; it just wouldn’t likely help the workers who need it most or help enough people to actually offset the ensuing inflation and job loss.

Aside from discussing big-issue topics like minimum wage and poverty in the U.S., Regalia also admitted that while economists tend to be “practitioners of the dismal science,” outlining worst-case scenarios and the like, the doctor giving a bad prognosis can also prescribe treatment.

“You can’t have bad living habits—single-malt scotch and extra pizza every night—and expect to live another 50 years,” he said. “The health of the nation’s economy is the same way; we have to bolster the workforce and lower government debt.”

In essence, take it out for walks twice a day.