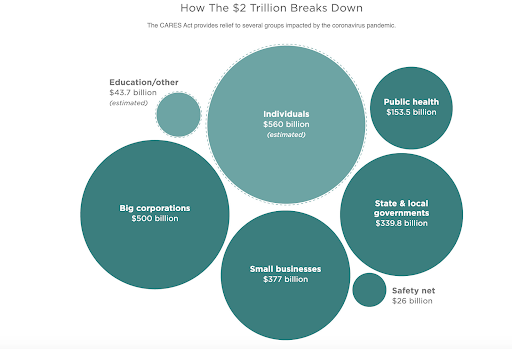

With $2.2 trillion being handed out by the federal government in three weeks—there’s something students should know. Many college-aged students do not qualify for the individual coronavirus relief rebate. Anyone who is claimed as a dependant on someone else’s taxes is ineligible.

On Friday, March 27, Congress passed the Coronavirus Aid, Relief and Economic Security Act or CARES Act. The intent of the bill is “To provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic.” President Donald Trump signed the bill into law later that day.

“This is an unprecedented amount of money being spent by the government to stimulate the economy,” McDonnell said.

After the 2008-2009 recession, the federal government gave out tax breaks near $800-900 over multiple years, McDonnel said, far less than what is currently being provided.

The CARES Act does provide federal student loan forgiveness. Meaning students have the option to stop paying their federal student loans through Sept. 20, 2020 and no interest will accrue. Federal student debt collection has also been halted for 60 days.

“The bill provides some confidence that there will be sufficient ability to spend once the economic restrictions begin to be lifted,” said Head of the NMU economics department Gary McDonnell. “Many people fear that without this aid, spending will not recover, which could create a prolonged recession.”

The bill is meant to help many groups. Individuals can receive checks up to $1,200 per person based on their gross annual income. Unemployed individuals will see increased unemployment benefits. Businesses—big and small—will receive help to continue paying their employees, McDonnell said.

“For example, airlines are one of the hardest hit industries of this crisis and will receive money from this spending bill to keep paying their employees. This is not unprecedented,” McDonnell said. “The airline industry received a government “bailout” following the attacks of September 11, 2001. The auto industry was bailed out in a similar fashion during the Great Recession of 2008-2009.”

The bill is not all “government hand-outs” some of the money given is in the form of loans and will need to be paid back.

Individuals who qualify for the $1,200 will not have to pay it back. Those who have filed their 2018 and 2019 taxes should see a direct deposit in about three weeks.

So who qualifies for individual recovery rebates?

If an individual’s income is $75,000 annually or below they will receive the full $1,200 and $2,400 for married couples making $150,000 or less annually. Plus an additional $500 per child, a child is defined as a person 17 years old or younger according to the bill. The payment declines for those who make more and eventually phases out for individuals who make more than $99,000 annually.

Section e3 under ‘Recovery Rebates for Individuals’ states which individuals are ineligible—anyone claimed as a dependent, non-resident aliens and estates or trusts are ineligible.

Even if students file their own taxes they can still be claimed as a dependent until they’re 24 years old. A college-aged student is ineligible if they are claimed as a dependent on someone’s taxes.

Those who have not completed their 2018 and 2019 taxes could see a delay in payment. Those who have direct deposit set up for tax refunds will receive a direct deposit, if not, checks will be sent in the mail. US citizens with annual income of $99,000 or less will receive up to $1200, excluding those claimed as dependents. Students and those recently graduated will receive some relief from student loans at this time.