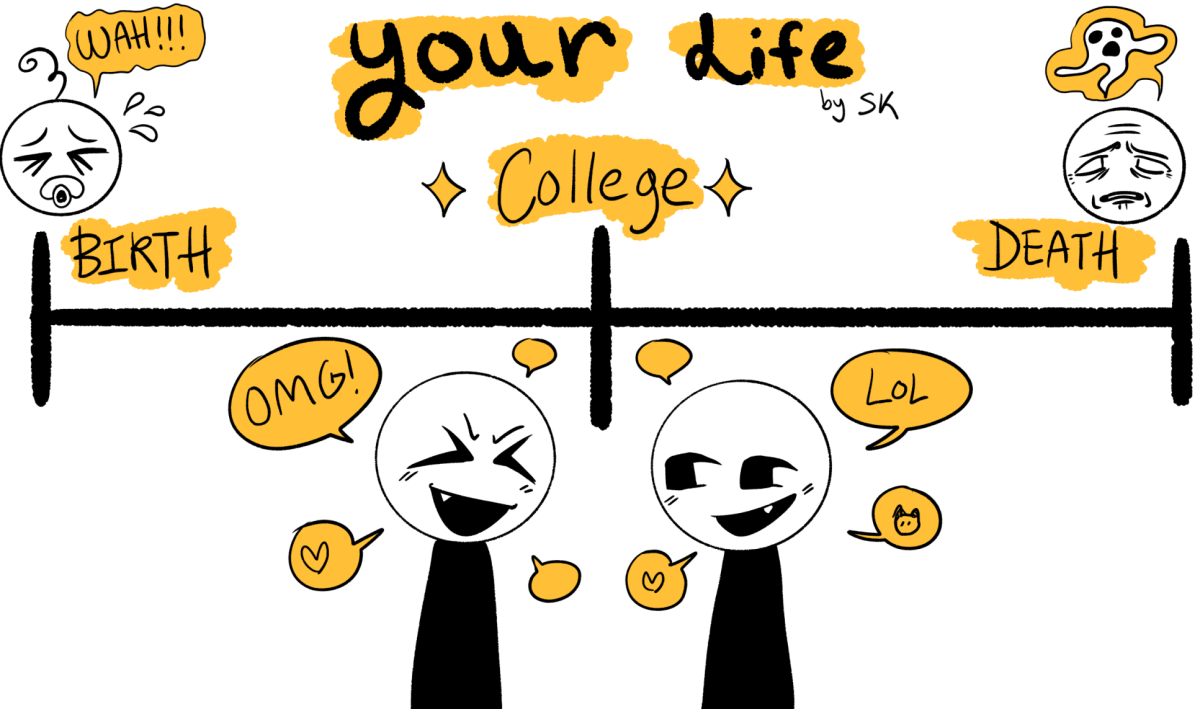

Debt or more debt — this is the question most students are forced to ask when facing the prospect of higher education.

Meghan Whitenton, who graduated with honors from NMU this May with a bachelor’s in English, was confronted with a harsh reality when she sat down for exit counseling in the spring.

“It was a moment of grave realization, of exactly what the future looks like with that amount of debt,” Whitenton said.

She is certainly not alone.

Student debt has exceeded $1 trillion dollars nationwide, according to a report by americanprogress.org, eclipsing credit card and auto loans. It is the only form of consumer debt that has continued to grow since the financial collapse of 2008, putting the average debt for the class of 2010 at about $25,000, which is 5 percent more than in 2009 according to the nonprofit research group Institute for College Access and Success.

“Student debt is this sacred cow,” said NMU economics professor Tawni Ferrarini. “[People think] it’s okay to accumulate it, but don’t think about how they’re going to pay it back in the future.”

Whitenton, who has worked part- or full-time her entire academic career, is a Ronald McNair Scholar and graduated with her associate’s debt-free and with honors from Oakland University. She is part of Phi Theta Kappa and Honor’s Society, as well as the first person in her family to graduate with a degree.

“Despite working, I’m still unable to afford tuition, books or to be able to support myself without loans,” she said. “I know that I need to take personal responsibility for borrowing that money, but looking back, I feel resentful because the American education system tries to create this notion or illusion that when you’re done with school…you’ll have all these opportunities.”

In 2010, the unemployment rate for young college graduates was 9.1 percent, the highest annual rate on record, according to The Institute for College Access and Success.

“When [students] take on debt today, that means they’re going to be able to consume, save, invest and give to others less in the future,” Ferrarini said. “So it’s a tradeoff.”

Based on data from the National Postsecondary Student Aid Study conducted by the Department of Education, the average debt levels for graduating seniors with loans rose almost 82 percent from 1996 to 2008, a bubble expected to have adverse effects on the broader economy.

Bridget Podner, a fifth-year transfer student, said she has also worked throughout school to keep her debt low.

“It’s definitely worrisome,” she said, adding that students need to be counseled about the long-term burden of debt before accepting the overage checks often available at NMU through financial aid.

But not all loans are created equal, and it is important for students to know exactly what their options are in order to accumulate the least amount of debt.

According to Consumer Reports, taking out more than your first year’s projected salary means planning on longer than 10 years for repayment. If students find they can’t afford to pay, there are applications for deferment or forbearance, and they should contact their lender immediately to avoid late fees and defaulting, which will hurt their credit score.

Families should be wary of private loans, which have variable interest rates and are nearly impossible to discharge in bankruptcy, according to the nonprofit Project on Student Debt. They point out that private loans are not eligible for deferment, income-based repayment or loan forgiveness, like federal loans are, and the percentage of graduates with private loans increased from 5 percent in 2003-04 to 14 percent in 2007-08.

There is reason for optimism though. According to the 2010-11 Michigan State University Recruiting Trends study, hiring is expected to increase by 3 percent, with hiring of college graduates expected to increase by nearly 10 percent by next year.

“What we have to do in this era is identify a niche, a specialization, or some type of comparative advantage that helps us stand out from the people around us with the same college degree,” Ferrarini said.

“It boils down to individual choices,” she said. “Be informed. Make strategic decisions. Don’t just follow the herd because everyone else is doing it.”