Quinlan Scully is a junior graphic design student who has managed to save enough money to have an emergency fund. Having lived through the major financial collapse in 2009, Scully became resolute in having a backup fund and was able to put away $1,000 for an emergency.

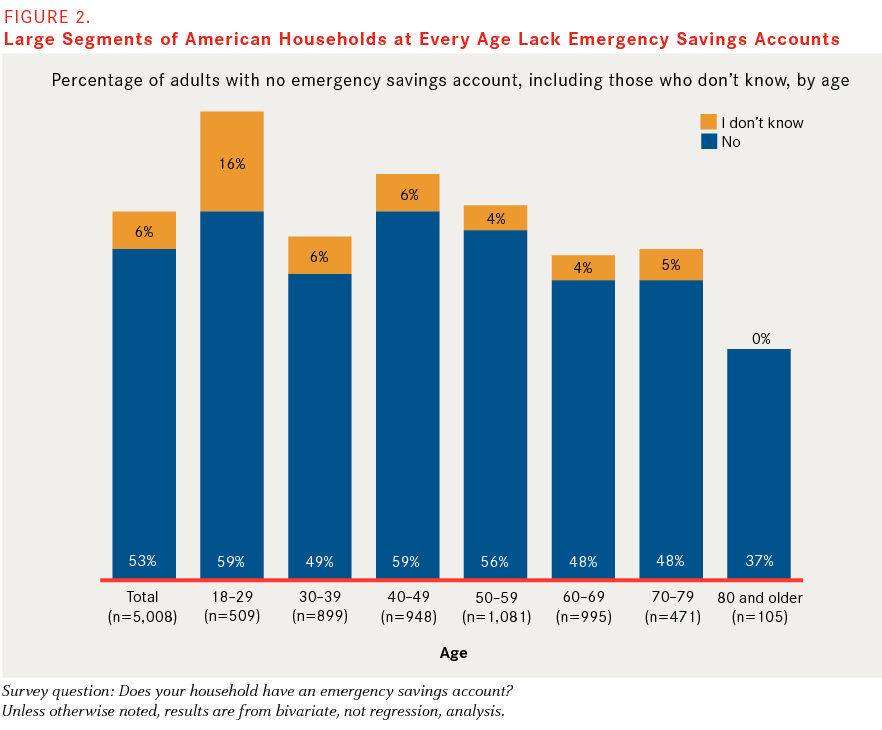

Many college students are struggling to save for such an emergency fund. A study published in Oct. 2019 by the American Association of Retired Persons (AARP) found that 75% of adults aged 18-29 have either no emergency fund or are unsure if they have saved enough for a pinch.

The struggle many Americans face when saving for a dire situation can be accounting for emergency expenses, rent, student loan bills and paying for food, which is some of the many costs college-aged students face.

According to the study, “Rules of Thumb in Household Savings Decisions: Estimation Using Threshold Regression” published in Nov. 2019, AARP researchers found that a Federal Reserve survey estimated that almost half of U.S. households could not easily handle an emergency expense of just $400.

Through an emergency fund, Scully has been able to be financially stable during the COVID-19 outbreak, unlike many of his friends. He has also been able to turn some of his emergency funds into profit while prices are low.

“I’m lucky I had some disposable income and was able to invest in the stock market. I’ve made about $500 off of some oil stocks this week after the prices dropped,” Scully said.

Although Scully has had some recent luck in the stock market, Carol Johnson, dean of the NMU School of Business, stresses that the most important thing a college-aged student can do to prepare for a pandemic is budget.

“If anything, this is teaching us how important it is to have an emergency fund. You hate to plan for a contingency as bad as this, but an emergency fund is essential,” Johnson said.

Johnson urges students who are struggling to build up an emergency fund to make a budget. Students who evaluate their spending can find ways to cut back and create an emergency savings plan that works for them, Johnson said.

Many of Scully’s friends did not have an emergency fund, and they are having financial problems during the pandemic.

“I hate to see it but a lot of my friends are really struggling right now because they can’t afford to keep up with their rent payments. Saving is already a huge issue for a lot of people; with the pandemic added on it seems unbearable,” Scully said. “All I can really say to other students in a dilemma is to truly evaluate what costs you can cut down on and what is a necessity.”