Opinion — How to buy a house before you graduate

April 24, 2023

I know what you’re thinking: “I can’t afford to buy a house right now. I’m a broke college kid.”

What if I told you that if you open a Michigan First Time Home Buyer savings account you will have enough money for a down payment on a house in no time? This account allows a first-time home buyer to put up to $5,000 in it a year. Over the next few years, it will accrue interest and won’t be taxed.

The maximum amount that can be in the account is $50,000, and once you’ve reached this threshold, it will continue to build interest. It is the perfect way to save money for a future home purchase. The dream of letting your dog run around in the fenced-in backyard, or the walk-in closet and ensuite bathroom is possible if you start saving now.

Now you might be wondering, how do I open this account? The first step is to open a new savings account or use an existing one. Then on the current year’s tax income return, you put the purpose of this account. When it comes time for taxes, there is a deduction in state income tax collection for the amount in the account.

This is a huge benefit, for this account will be getting more money in it from interest and won’t be taxed. I strongly recommend every college student start a First Time Home Buyer savings account because it will set you up for your future homeowner dreams. When you need ideas for a gift, ask your family to contribute to your First Time Home Buyer savings account to go towards your future.

Now I am going to debunk a first-time home buyer myth. Most people think you need to have a 20% down payment when purchasing a home. I’m here to tell you eight times out of 10 you won’t need 20%.

There are many factors to consider when determining a down payment amount. First is your credit score – having a good credit score is a big advantage. Second is how good your debt-to-income ratio is. Having low debt and a good credit score will allow the bank to offer a mortgage with a lower down payment.

Another thing that would help decrease the down payment percentage is First Time Home Buyer grants and programs. FHA loans could have as low as a 3.5% down payment with a credit score above 580. This loan is perfect for college students who don’t have a huge savings account or long credit history.

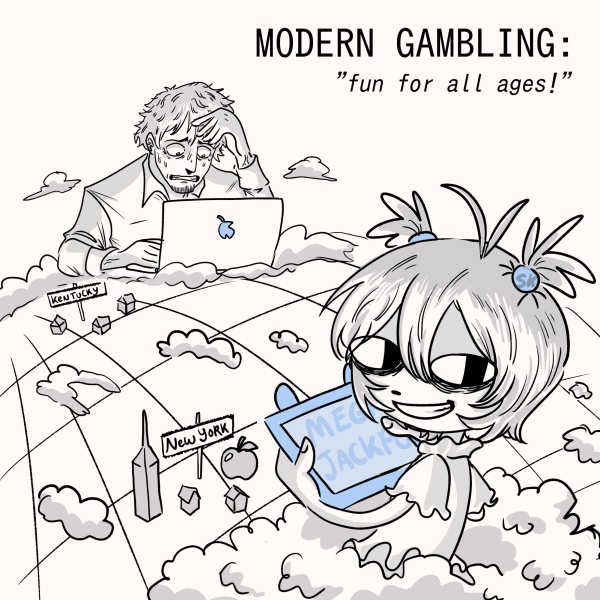

Putting a 3.5% down payment on a $250,000 house is only $8,750. If you rent a house for $750 per month for a year that is $9,000. It is more to rent for a year than it could be to just put a 3.5% down payment on a whole house! Buying property early on and renting out to friends is a better investment of your money and time in the long run than renting.

It is an expensive endeavor, but with your Michigan First Time Home Buyer savings account, a good credit score, a low debt-to-income ratio and first-time home buyer programs, you will be in your first home in no time chasing your dog around the backyard.

More information on this savings account can be found at First Home Michigan. Just think, by giving up two Starbucks a week, in a year you would have over $500 in your savings account towards your future home. Think of what else you could forgo …

Editor’s Note: The North Wind is committed to offering a free and open public forum of ideas, publishing a wide range of viewpoints to accurately represent the NMU student body. This piece is a guest column, written by a Northern Michigan University student, faculty member, or community member. It expresses the personal opinions of the individual writer, and does not necessarily reflect the views of the North Wind. The North Wind reserves the right to avoid publishing columns that do not meet the North Wind’s publication standards. To submit a guest column contact the opinion editor at [email protected] with the subject North Wind Guest Column.