As part of the government’s attempts to financially protect Americans from the negative effects of the coronavirus pandemic, federal student loan payments have been suspended since March 13, continuing until Sept 30.

This was accomplished through the Coronavirus Aid, Relief and Economic Security (CARES) Act, signed into law by President Trump on March 27.

What does this mean for students in plain terms?

The CARES Act puts a temporary stop to student loan payments and to the government collecting money and garnishing wages for defaulted student loans. Beginning on March 13, no interest will be calculated on top of loans, NMU Financial Aid Director Michael Rotundo said.

Originally, the government suspended the accruement of interest for 60 days, but this was expanded by the CARES Act. Automatic debit payment will be stopped, and any that went through from March 13 to Sept. 30 can be refunded, according to the Student Loan Borrower Assistance website.

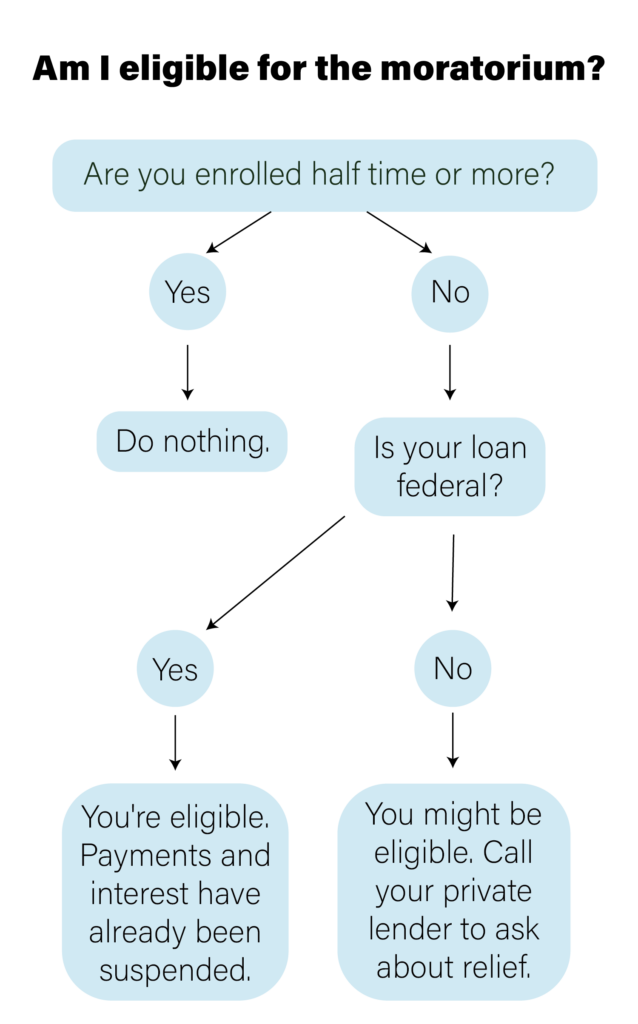

Who is eligible for the moratorium?

A moratorium is a period in which payments are legally delayed. Anyone who has taken out Direct Loans and Federal Family Education Loans that are currently owned by the federal government can use the benefits of the CARES Act. According to Loan Borrower Assistance, Perkins Loans and commercially-held Federal Family Education Loans are not covered by the CARE Act and neither are private student loans.

Although private student loans are not included in the CARES Act, many private lenders are still giving some type of coronavirus relief.

“We have heard from many of the private lenders that they are offering assistance and repayment relief to student loan borrowers who are in repayment, or who have payments required while enrolled (not deferred),” according to the NMU Financial Aid website.

How can you acquire student loan relief?

The stoppage is automatic. If you have a federal loan, your payments and interest have already been suspended, Rotundo said.

Remember that if you are currently enrolled as a student with a course load of at least half time (comprising 6 credits for undergraduates and 4 for graduate students), you do not need to take any action, as your loans are already deferred.

If your lender is not federal, you can visit their web sites and contact them to determine your options for deferring payments. NMU has recommendations for speaking to your lenders.

“Folks with student loans should be checking with their lender or loan servicer about options,” Rotundo said.

Students are advised to be courteous because information may not be readily available to representatives to answer student questions fully and promptly. Simply inform your lender about the effects of the coronavirus on your finances, and explain why you would like some form of debt relief. Ask what options are available, and write them down.

“This is still a fairly fluid topic,” Rotundo said. “There is some student loan information that is coming out through the CARES Act. We are continuing to monitor this as more information becomes available.”

NMU has additional resources to help students who are unable to receive relief from their lenders or for whom the moratorium is not enough to save their finances, such as the Wildcat 2020 Student Relief Fund, which is now open to applications through the Donor Funded Scholarship application system.

A few lenders that are offering some form of relief include: Sallie Mae, Discover, LendKey, Wells Fargo, Citizens. Links to their coronavirus resources can be found through NMU Financial Aid.

Students can find continuously updated information from NMU Financial aid at https://www.nmu.edu/financialaid/covid-19-borrower-relief-information.

Students can find information about federal student loans from the U.S. Department of Education at https://studentaid.gov/announcements-events/coronavirus.